Wayne Lowry

The role of insurance in direct primary care often prompts questions: How does insurance fit into this patient-centric model? Here’s a brief overview of how insurance fits into the DPC model:

Direct Primary Care is changing healthcare by focusing on simplicity and personal care. People want to move away from complex insurance systems and find this model appealing because it’s straightforward. It offers quick access and clear costs, meeting the need for efficient services. This is especially important for those who want fast and complete solutions for their healthcare needs.

Understanding Direct Primary Care

Direct Primary Care (DPC) is changing how we think about healthcare. It’s all about simplicity, transparency, and putting patients first. Let’s break down what makes DPC so appealing.

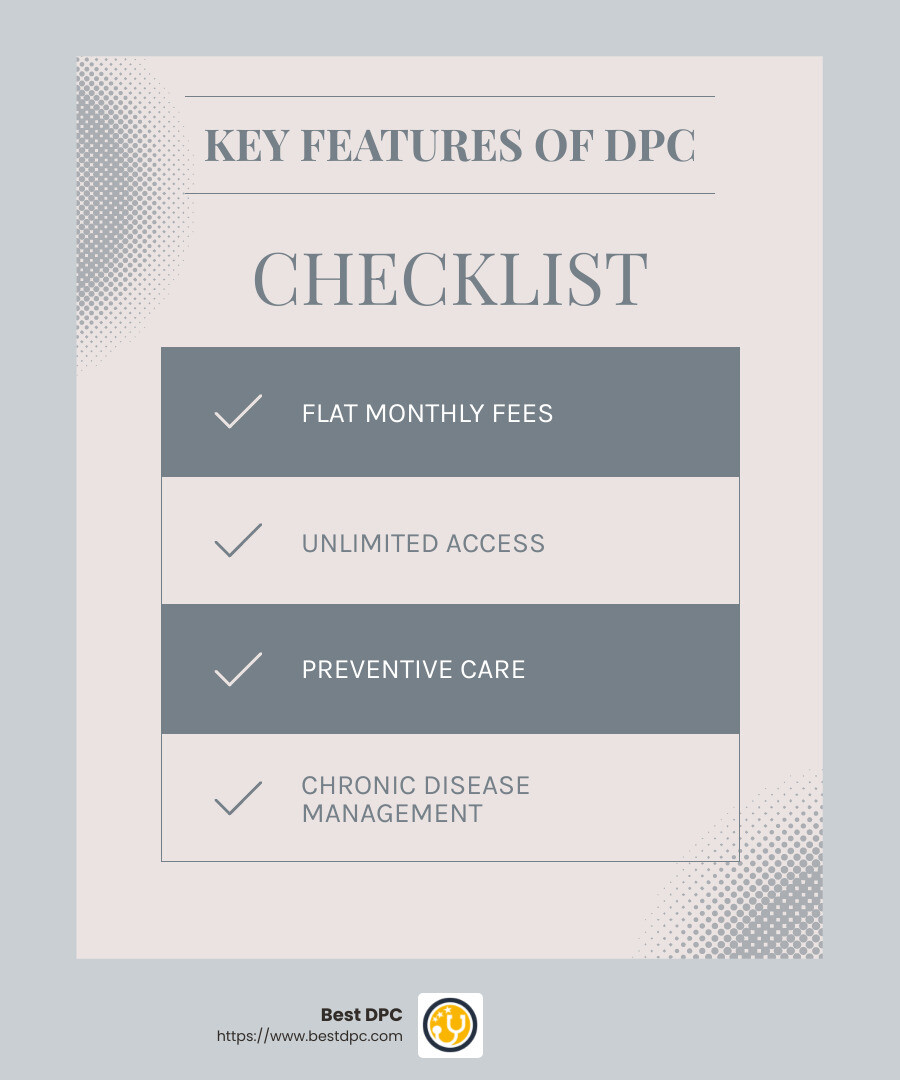

Flat Monthly Fees

In DPC, you pay a flat monthly fee. This fee covers a wide range of primary care services. Think of it like a subscription, similar to Netflix or Spotify, but for your healthcare needs. Instead of paying a co-pay every time you visit the doctor, your monthly fee covers it all. This means no surprise bills or hidden fees.

Unlimited Access

One of the standout features of DPC is unlimited access to your primary care provider. You can see your doctor as often as you need, without worrying about extra costs. Whether it’s a routine check-up, managing a chronic condition, or just needing some advice, you have the freedom to get the care you need when you need it.

Imagine being able to call or message your doctor directly. Many DPC practices offer this kind of access, allowing for quick questions or concerns to be addressed without the need for an office visit. This level of accessibility is rare in traditional healthcare systems and is a huge benefit of DPC.

Primary Care Services

DPC covers a broad spectrum of primary care services. This includes preventive care, chronic disease management, and even some urgent care needs. The goal is to keep you healthy, prevent issues before they become serious, and manage ongoing health conditions effectively.

DPC practices focus on comprehensive primary care, allowing doctors to spend more time with each patient. This means longer appointments and more personalized care. Doctors can explore your health concerns in detail and collaborate with you to develop a custom health plan.

In summary, Direct Primary Care offers a refreshing alternative to traditional healthcare models. With flat monthly fees, unlimited access, and a focus on comprehensive primary care services, it’s no wonder more people are choosing DPC for their healthcare needs.

Next, we’ll look at how insurance fits into this model and how it can complement your DPC membership.

Role of Insurance in Direct Primary Care

Direct Primary Care (DPC) is an innovative healthcare model focusing on simplicity and patient care. But where does insurance fit into this picture? Let’s explore the role of insurance in direct primary care.

Insurance as a Safety Net

Insurance plays a crucial role in DPC by serving as a safety net. While DPC covers routine and preventive care, insurance steps in for the big stuff—catastrophic coverage.

Imagine a scenario where a sudden health crisis requires hospitalization or specialized treatment. This is where insurance shines. It covers those unexpected, high-cost events and specialist care that DPC typically doesn’t handle.

High-deductible health plans (HDHPs) are a popular choice for DPC members. These plans have lower monthly premiums, making them an affordable option for many. They provide coverage for major medical events after the deductible is met, ensuring financial protection when you need it most.

Combining DPC with Insurance

Pairing DPC with insurance can lead to significant cost savings and provide a more comprehensive care approach.

Here’s how it works:

Insurance complements DPC by offering a safety net for major health events while keeping routine care affordable and accessible. This strategic pairing provides a balanced, cost-effective healthcare solution.

Let’s dive into the specific benefits of Direct Primary Care and why it’s gaining popularity.

Benefits of Direct Primary Care

Efficiency and Cost Transparency

Direct Primary Care (DPC) offers a fresh approach to healthcare, focusing on simplicity and patient satisfaction. Let’s explore what makes DPC stand out.

Accessibility: DPC provides easy access to healthcare. Patients enjoy same-day or next-day appointments, ensuring timely care. This model reduces the long wait times often seen in traditional healthcare settings.

Preventive Care: With DPC, preventive care is a priority. Regular check-ups and early intervention help catch health issues before they become serious. This proactive approach leads to better health outcomes and can save money in the long run.

Personalized Care: DPC doctors have fewer patients, allowing them to spend more time with each one. This means personalized attention and a deeper understanding of your health needs. It’s like having a doctor who truly knows you.

No Insurance Claims: Say goodbye to the hassle of insurance claims. DPC operates on a membership model, eliminating the need for billing insurance for routine visits. This means less paperwork and more focus on your health.

Predictable Costs: With Direct Primary Care, you pay a fixed monthly fee that includes most primary care services. This means no unexpected bills. Knowing your healthcare costs each month helps you budget more easily.

Extended Visits: DPC allows for longer doctor visits, often lasting 30 to 60 minutes. This extra time means more thorough care and the chance to address all your concerns in one visit.

Direct Primary Care focuses on accessibility, personalized care, and predictable costs. This creates a streamlined healthcare experience that puts patient needs first. Next, we’ll answer common questions about how DPC and insurance work together.

Frequently Asked Questions about Direct Primary Care and Insurance

Does DPC count as insurance?

No, Direct Primary Care (DPC) is not insurance. Instead, it operates on a membership model. You pay a flat monthly fee for access to primary care services. This fee covers routine visits, making healthcare more predictable and straightforward.

However, since DPC is not insurance, you still need additional coverage for major medical expenses. Think of DPC as your go-to for everyday health needs, while insurance acts as a safety net for emergencies and specialized care.

How does DPC work with traditional insurance?

DPC and traditional insurance play complementary roles in your healthcare. While DPC covers routine and preventive care, insurance steps in for catastrophic events like hospitalizations or surgeries.

Many people combine DPC with high-deductible insurance plans. These plans have lower monthly payments, which makes them easier on the wallet. You rely on DPC for routine visits and small health issues, while your insurance covers major, unexpected expenses.

This combination is cost-effective. It reduces the need for frequent insurance claims, which can lower overall healthcare expenses. Plus, it offers the best of both worlds: comprehensive care without breaking the bank.

Is DPC worth it?

Absolutely! DPC offers numerous patient benefits. It provides easy access to care, personalized attention, and no surprise bills. With DPC, you get more time with your doctor, leading to improved care and better health outcomes.

Cost savings are another big plus. The fixed monthly fee covers most primary care services, helping you avoid high co-pays and deductibles. By using DPC for routine care, you can save money while still having insurance for major medical needs.

DPC is a smart choice for those seeking a simple, personalized, and affordable healthcare experience. Next, let’s dive into how Best DPC can help you steer this innovative healthcare model.

Conclusion

At Best DPC, we believe in changing healthcare into a holistic experience that puts you, the patient, at the center. Our approach combines the benefits of Direct Primary Care (DPC) with the security of traditional insurance, offering a balanced and comprehensive healthcare solution.

Take charge of your health today with a Direct Primary Care subscription. Visit Best DPC now and find the provider that fits your needs, all while enjoying transparent, affordable care.

ABOUT AUTHOR

Wayne Lowry

Wayne Lowry, Founder of BestDPC, is a passionate advocate for Direct Primary Care (DPC) and its mission to deliver personalized, accessible healthcare. He believes that DPC providers should serve as the trusted first point of contact for all medical needs, ensuring patients never feel isolated or uncertain about their health decisions. Through his work, he champions a patient-first approach to healthcare, building a system that prioritizes guidance, support, and trust.

Thank You for Registering!

Your registration was successful! We're excited to have you on board. Please check your email for a confirmation link to complete your registration.